Forex trading is a highly dynamic and lucrative investment opportunity, and many traders turn to trading forex in tradingview Trading Platform HK to enhance their trading experience. In this comprehensive guide, we will explore how to effectively use TradingView for Forex trading, ensuring you have the tools and knowledge needed to succeed in this competitive market.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market in the world, where currencies are traded. Unlike stock markets, Forex operates 24 hours a day, allowing traders to execute trades at any time. The Forex market is known for its liquidity, volatility, and the possibility of high returns, making it an attractive option for both novice and experienced traders.

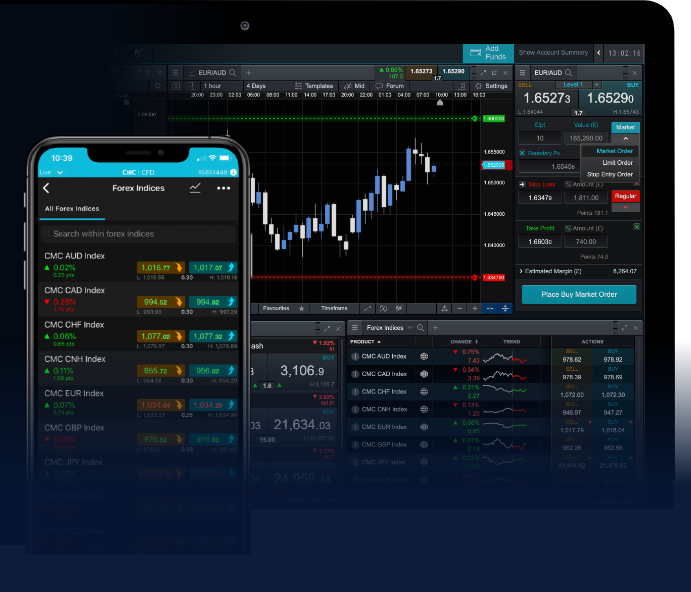

The Role of TradingView in Forex Trading

TradingView is a powerful charting platform and social network designed for traders and investors. It provides advanced charting tools, social networking, and a rich library of indicators. For Forex traders, TradingView offers a customizable experience, enabling users to analyze market trends and make informed trading decisions. Here’s how to leverage TradingView for Forex trading:

Creating an Account on TradingView

To start using TradingView, you need to create an account. The process is straightforward:

- Visit the TradingView website.

- Click on the ‘Join for free’ button.

- Fill out the necessary information or sign up using your Google or Facebook account.

Once your account is created, you can access various features tailored for Forex traders.

Exploring the User Interface

The TradingView user interface is intuitive and user-friendly. Here are some key components you should familiarize yourself with:

- Chart Area: The primary section where you analyze price movements.

- Toolbox: Contains drawing tools, indicators, and charting options.

- Watchlist: A customizable list of currencies you want to track.

- News Feed: Stay updated with the latest market news and developments.

Utilizing Charting Tools and Indicators

One of the standout features of TradingView is its extensive range of charting tools and indicators. As a Forex trader, you can:

- Analyze Candlestick Patterns: Utilize candlestick charts to identify trends and reversals.

- Use Technical Indicators: Apply indicators such as Moving Averages, RSI, and MACD to gauge market momentum.

- Create Custom Indicators: Build your own indicators using TradingView’s Pine Script language.

These tools can significantly enhance your analysis and help you make more informed trading decisions.

Developing Your Trading Strategy

To be successful in Forex trading, it’s crucial to develop a clear trading strategy. Here’s a step-by-step approach to creating an effective Forex trading strategy using TradingView:

1. Set Your Goals

Before jumping into trades, determine your trading goals. Are you looking for short-term gains, or are you in it for the long haul? Setting clear goals will guide your trading decisions.

2. Conduct Technical Analysis

Utilize the charting tools on TradingView to conduct thorough technical analysis. Look for key support and resistance levels, trends, and chart patterns that could signal entry and exit points.

3. Implement Risk Management

Risk management is crucial in Forex trading. Establish rules regarding how much you’re willing to risk on each trade. Utilize stop-loss orders and position sizing to protect your capital.

4. Test Your Strategy

Before deploying your strategy in the live market, use TradingView’s paper trading feature to test your strategy. This allows you to simulate trades without risking real money, giving you insights into the effectiveness of your approach.

5. Review and Adjust

Regularly review your trades and adjust your strategy as needed. Analyze what worked and what didn’t, and be willing to adapt to changing market conditions.

Engaging with the Trading Community

One of the unique aspects of TradingView is its vibrant community of traders. Join discussions, share ideas, and learn from the experiences of others:

- Follow Other Traders: Discover successful traders and learn from their strategies.

- Share Your Ideas: Publish your analysis and receive feedback from the community.

- Participate in Webinars: Enhance your knowledge and skills through educational webinars hosted by experts.

Integrating Fundamental Analysis

While technical analysis is vital, incorporating fundamental analysis into your Forex trading approach can provide a more comprehensive view of the market. Keep an eye on economic indicators, geopolitical events, and central bank announcements that can affect currency values.

TradingView offers a news feed and economic calendar that allows you to stay updated on critical events and market-moving information.

Conclusion

Forex trading on TradingView can be an exciting and profitable venture if you approach it with the right tools and strategies. By understanding the platform, utilizing its advanced features, and engaging with the trading community, you can enhance your trading experience and increase your chances of success.

Start your journey today by creating an account on TradingView, and immerse yourself in the world of Forex trading like never before!