Beginner’s Guide to Forex Trading: A Comprehensive Course

Forex trading offers a unique opportunity for individuals to profit through the exchange of currencies. As a beginner, you might feel overwhelmed by the intricacies involved in the Forex market. That’s why taking a well-structured forex trading course for beginners Cameroonian Trading Platforms course is essential for newcomers. This article serves as a comprehensive guide to help you navigate your journey in Forex trading, laying down the basic concepts, terminology, and strategies that will set you on the right path.

Understanding Forex Trading

Forex, or foreign exchange, is the process of exchanging one currency for another at an agreed price. The Forex market is highly liquid, decentralized, and operates 24 hours a day, opening on Sunday evening and closing on Friday evening. As a beginner, your first goal should be to familiarize yourself with how currency pairs work, what factors influence their value, and the essential trading concepts.

Currency Pairs

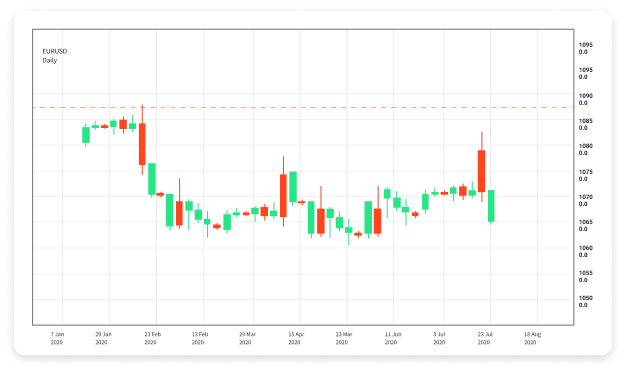

Currencies are traded in pairs, for example, EUR/USD, GBP/JPY, or AUD/NZD. The first currency in the pair is known as the base currency, while the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding how to read and interpret these pairs is crucial for successful trading.

Market Participants

The Forex market consists of various participants, including central banks, financial institutions, corporations, and individual traders. Each participant has different motivations for trading, which helps create a dynamic market environment. As a beginner, keep in mind that understanding your competition can provide valuable insights into market movements.

Key Terminology to Know

- Pip: The smallest price move in the Forex market, typically a one-digit change in the fourth decimal place.

- Spread: The difference between the bid (selling) price and the ask (buying) price for a currency pair.

- Leverage: A tool that allows traders to control a larger position than their initial capital would allow.

- Margin: The amount of capital required to open and maintain a leveraged position.

Creating a Trading Plan

Once you have a grasp of the fundamentals, the next step is to formulate a trading plan. A well-defined trading plan outlines your trading goals, strategy, risk management techniques, and evaluation criteria. Here’s what to consider:

- Trading Goals: Define clear goals, whether they are to earn a side income or to trade full-time.

- Strategy: Decide which trading style suits you—day trading, swing trading, or long-term investing.

- Risk Management: Establish risk-reward ratios, stop-loss orders, and daily limits to protect your capital.

Types of Analysis

Different types of analysis can help you make informed trading decisions:

- Technical Analysis: Involves studying historical price charts using various indicators and patterns to predict future movements.

- Fundamental Analysis: Focuses on economic indicators, news events, and geopolitical situations that can influence currency values.

- Sentiment Analysis: Assesses the overall mood of the market, which could provide insight into potential price movements.

Choosing a Broker

Choosing the right Forex broker is critical for your success. Look for brokers that are regulated, provide a user-friendly platform, low spreads, and excellent customer service. Research brokerage reviews and check their offerings, such as educational resources and demo accounts, before making a commitment.

Demo Trading

Before risking real money, consider practicing through a demo account. Most brokers offer this feature, allowing you to trade with virtual currency while gaining valuable experience. Take your time to develop your skills and confidence before transitioning to live trading.

Developing Emotional Discipline

One often-overlooked aspect of trading is the psychological component. Emotions like fear and greed can significantly impact decision-making. Developing emotional discipline is crucial to stay focused on your trading plan. Here are some tips:

- Always stick to your trading plan.

- Avoid revenge trading after losses.

- Maintain a balanced life outside of trading activities.

Continuous Learning and Adaptation

The Forex market is constantly evolving, and staying updated is vital. Continue learning through courses, webinars, and market analyses. Join online trading communities to share insights and experiences with other traders.

Conclusion

Forex trading can be a rewarding endeavor if approached with the right knowledge and tools. This beginners’ course is just the start of your trading journey. Remember to practice diligently, maintain emotional discipline, and continue your education consistently. With time, patience, and dedication, you can master the art of Forex trading and achieve your financial goals.